IN Lagos, Nigeria’s commercial capital, agberos fleece the state of billions of naira in transport taxes collected from drivers of commercial buses, tricycles and motorcycles.

There are 75,000 commercial buses (danfos) in Lagos, according to the Lagos Metropolitan Area Transport Authority (LAMATA) estimates.

Each commercial vehicle driver pays at least N3,000 to agberos, also known as ticket touts, every day, according to oral testimonies and estimates obtained by this reporter from more than 50 commercial bus drivers in 21 out of 37 local council development authorities (LCDAs) in Lagos.

This means that these drivers pay an average of N225 million each day, N6.75 billion each month, and N82.125 billion each year to agberos in Lagos, according to The ICIR’s estimates.

That is not all. There are at least 50,000 tricycles (Keke Marwas) in Lagos, according to a 2020 report by Techcabal – Never mind the Lagos State government’s recent ban, which is just a mere pronouncement.

Read Also:

Inside Lagos local government councils where officials divert taxes to personal bank accounts

Inside suspension of Emirates, Air Peace flights from Nigeria to Dubai

More than 60 tricycle drivers in 21 LCDAs in the commercial city told this reporter that they paid at least N1,800 to agberos each day.

This, therefore, means that each day, agberos walk off with N90 million from transport taxes collected from tricycle drivers. Every month, their pay reaches N2.7 billion, rising further to N32.85 billion every year.

The average collection, however, is higher in Mushin (N2,500 – N3300), Isolo (N1,900-N2,200), Oshodi (N1800-N2,300), Coker/Aguda (N2200-N3,000) Itire/ Ikate (N2,200 -N3,200), Iru-Victoria(N2,300-N3,200), Ikeja (N2200- N2500), and Onigbongbo (N2200-N3,000) LCDAs, among others, the investigation showed.

“They often collect the money by force. Sometimes you pay in their make-shift offices, at other times you hand them the cash,” a tricyclist operating in Mushin Local Government Area told The ICIR.

Another tricyclist, who did not want her name and location mentioned, said she was tired of plying the trade because the touts often eroded her profits after the day’s hard work.

“Here, I pay up to N2500 every day, buy fuel, pay N200 to the police, N200 to traffic officials of the Lagos State Traffic Management Authority (LASTMA) and what do I have left?” she asked, rhetorically.

But Danfos and Keke Marwas are not the only means of land transportation in Lagos. Never mind the Lagos State government’s pretense on motorcycle (Okada) ban, members of the Motorcycle Operators’ Association of Lagos State (MOALS) told this reporter that there were no fewer than 1000 motorcycles in each LCDA in the state.

During interviews with motorcycle riders in Lagos that spanned two months, the reporter was told that each motorcyclist must hand out N400 and N800 each day to agberos. Based on interviews with tricycle riders in 21 LCDAs in Lagos, this reporter arrived at an average spend of N600 per day.

One member of MOALS, who gave his name as Haruna, agreed that the N600 estimate was correct, saying that it was a fair representation of what motorcycle riders paid to agberos each day.

Commercial motorcyclists or Okadas ply all the roads in the state except areas where there are some restrictions such as some parts of Eti Osa East LCDA and Ikoyi area of Ikoyi/Obalende LCDA. To avoid duplication, the reporter only considered 37 LCDAs in Lagos.

For clarity, there are 37 LCDAs and 20 local government areas in Lagos. The LCDAs are part of the larger local government areas. For instance, Isolo is an LCDA under Oshodi Local Government Area.

Going by estimates provided by MOALS members to the reporter, there are 37,000 commercial motorcycles in Nigeria’s commercial hub. By implication, motorcycle riders pay N22.2 million to agberos each day, N666 million every month, and N8.103 billion each year.

In total, commercial buses, tricyles and motorcycles pay N123.078 billion ($300.19 million) to agberos in Lagos each year. This excludes taxis, tankers and trailers as there are no relevant data on these categories.

“I don’t know exactly how much all of us make in Lagos, but I go home with N6000 to N8000 every day,” a ticket tout, also called agbero, operating in Ikorodu, north-east of Lagos, told The ICIR.

The agbero, who did not want his name in print, said he had been in the business for over 10 years and would like to remain in it for much longer.

Another agbero operating in Ojodu LCDA said he often went home with around N4500 to N6000 each day.

“But our chairmen ( leaders) go home with up to N10,000 to N15,000 every day,” the agbero, who gave his name as Tayo, said.

Lagos IGR and Agbero‘s revenue

The N123.078 billion generated by agberos each year amounts to 29.4 per cent of Lagos State’s Internally Generated Revenue (IGR) of N418.99 billion in 2020.

The amount is bigger than the IGR of any other state in Nigeria last year.

In 2020, oil-rich Rivers State was the second highest IGR generator after Lagos, but its IGR was N117.19 billion, according to the National Bureau of Statistics (NBS). The amount realised by Lagos agberos is N5.89 billion higher than Rivers State’s IGR last year.

It was followed by the Federal Capital Territory (FCT), which generated N92.06 billion in IGR – N31.018 billion lower than Lagos’ transport revenue.

Next was oil-rich Delta State, which generated N59.73 billion in IGR last year. Kaduna State generated N50.77 billion. Both were lower than transport tax realised by Lagos agberos by N63.35 billion and N72.31 billion respectively.

However, Lagos is the most indebted state in Nigeria, with a humongous N507.377 billion liability, according to the Debt Management Office (DMO)’s March 2021 report. The money generated by agberos can pay 24 per cent of the state’s debt, according to The ICIR‘s calculations, but the Lagos State government lacks the political will to take over the parks or re-organise them.

Who is an agbero?

‘Agbero’ is an informal word used in describing a person, usually a thug, who collects rates, fees, tolls and others forms of tax around motor parks.

In his ‘The Birth of the Agbero: A Toll Collector, A Menace of Lagos,’ Ayodeji Rotinwa wrote that agberos “are typically at bus stops and motor parks, the lots where buses begin their routes, and sometimes in front of shops and construction sites.

“They are often demanding money. Those at bus stops and in lots are often employees of the National Union of Road Transport Workers (NURTW), a private association that collects tolls by any means necessary from all public transporters—and which is maligned by all.”

In Lagos, agberos are non-state actors, but they are recognised by the state government. They belong to the powerful National Union of Road Transport Workers (NURTW) and the Road Transport Employers’ Association of Nigeria (RTEAN).

Revenue ends up in private pockets: There are pointers

Anyone looking at the N123.078 billion ($300.19 million) realised each year by agberos may think that the money goes into Lagos State account to be used for the welfare of over 20 million residents of Lagos.

But several pointers show that the money goes mostly into private pockets.

First, the amount is not recorded in Lagos State’s annual financial statements.

Normally in any audited financial statement, there is a section for the Statement of Financial Performance, which summarises the revenue and the expenditure of every organisation within a period. Revenue in this section is a sum total of all the income received in a financial period, usually a year.

Second, in the State Auditor-General’s Comments for Audited Account of Lagos State, revenue is defined as “only the gross inflow of economic benefits or service potential received or is receivable by the entity on its own account.”

The auditor-general’s report further says that “those amounts collected as an agent of government or on behalf of third parties are not considered as revenue.”

The implication is that transport taxes collected by agberos, who act as agents, are not considered as revenue.

The reporter reached out to two Lagos-based chartered accountants to ascertain whether this was a conventional accounting practice, but they answered in the negative.

Both accountants did not want their names in the paper for security reasons.

“If someone collects revenue on your behalf, the person is your agent and is entitled only to a commission agreed,” one of the accountants said.

The other accountant said it was an anomaly.

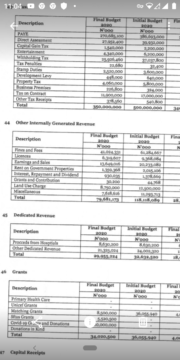

In Lagos State financial statements, tax revenues include: pay-as-you-earn, direct assessment, capital gains tax, entertainment tax, withholding tax, stamp duties, and development levy. Others are: business premises, tax on contract and other tax receipts.

Similarly, the financial statement has a chart for ‘Other Internally Generated Revenue,’ which includes: fines and fees; licences; earnings and sales; rent on government properties; as well as interest, repayment and dividend. Other IGRs are: grants and contribution; land use charge and miscellaneous. Transport tax or revenue has no place there.

There are no sections in the financial statements where details of the state’s transport revenue are recorded or explained.

The reporter contacted Service Delivery Director at Lagos State Accountant General’s Office Femi Ogunlana to get more information on transport taxes from the accountant general’s perspective. He said the accountant-general’s report or comment ‘was a compendium.’

When asked whether the accountant-general’s report often covered transport revenue in Lagos, he replied that “the accountant general does not report that way.” He, however, did not provide clarity to the question.

Web of secrecy -LIRS, Finance Ministry

The Lagos State Internal Revenue Service (LIRS) says on its website that ‘road taxes’ are among the 25 taxes that are collected by the state government.

But the government agency provides no evidence on the website that road taxes are being collected by the state government.

The reporter sent a text message to Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS) Monsurat Amasa to provide details of transport revenue in Lagos, but Amasa did not reply.

On June 21, The ICIR sent a Freedom of Information (FOI) request to the Executive Chairman of the LIRS Hamzat Ayodele Subair, requesting details of transport revenue of agberos in Lagos between 2015 and 2019, but he did not reply, though his office acknowledged receipt of the request letter by putting a stamp on it on June 23.

The Freedom of Information Act 2011 was passed by the National Assembly on May 24, 2011, and assented to by former President Goodluck Jonathan on May 28, 2011.

The FOI Act supersedes the Official Secrets Act (OSA) and it proposes that “public servants are custodians of a public trust on behalf of a population who have a right to know what they do.”

However, many public officials still refuse to disclose details of their activities or offices as stipulated by the FOI Act. The Act mandates public officials or even private entities of public interest to reply to pubic- interest requests in seven days.

The LIRS did not reply to the FOI request after seven days. A reminder was sent to the government agency, yet it did not respond after another seven days.

Similarly, text messages were sent to the Lagos State Commissioner of Finance Rabiu Olowo on July 1, requesting information on transport revenue in Lagos, but he did not reply.

He also did not respond to the FOI request sent to his office. One Abdulraziz, who claimed to work in the Lagos State Ministry of Finance, requested to see the reporter after acknowledging to have received the letter.

But the reporter declined, requesting him or his office to reply to the FOI request sent by The ICIR.

Abdulraziz later asked the reporter to speak with the Lagos State Ministry of Transport, but the reporter insisted that financial details of transactions in the state should be provided by the finance ministry, not the transport ministry.

Abdulraziz promised to ensure that the request was answered, but that did not happen before the story went to the press.

The NBS did not have the details

The National Bureau of Statistics (NBS) receives quarterly, six-monthly and annual IGRs of states in Nigeria.

The reporter contacted Head of Public Affairs & International Relations Unit of the NBS Sunday Ichedi, asking whether Lagos State government provided a breakdown of its IGR in 2020 or pre-2020, but he answered in the negative.

“States do not provide a breakdown, which is not so good for statistical purposes,” Ichedi said.

In other words, no agency in Lagos or outside of it provided details of transport revenue generated by ticket touts.

How agberos operate

Lagos agberos have what they call ‘pits,’ which is another name for ‘motor parks.’

Each ‘pit’ is manned by a chairman who oversees all the money collected in the park or parks in an area.

The chairman takes the huge chunk of the money, shares the rest to his subordinates and leaves little in an account operated by his union, the reporter found.

The National Union of Road Transport Workers (NURTW) in Lagos, which is the most powerful transport union in the state, is headed by Musiliu Akinsanya, popularly known as MC Oluomo.

Credit: naijacarnews.com

He is a rich man with strong political connections. In December 2020, his daughter Nofisat Akinsanya obtained a degree in Nursing from Georgia Southern University in the United States, a feat that can only be achieved by the daughter of privileged parents.

He recently completed a gigantic building at Oke-Afa/Ejigbo in Lagos.

In September 2019, while a caretaker chairman of the NURTW, Akinsanya hailed the National Leader of the All Progressives Congress (APC) Asiwaju Bola Tinubu and Governor Babajide Sanwo-Olu for supporting him to achieve the feat.

“I cannot but also thank my father, my leader, my mentor His Excellency, Asiwaju Bola Ahmed Tinubu, for his love and support towards my emergence as the NURTW chairman. He is truly a father and a father indeed,” he said, on his official Instagram handle, as reported by The Punch.

On the other hand, Chairman of the rival body RTEAN is a less-known Mohammed Musa, who has now been confirmed as the national president of the union.

The Tricycle Owners Association of Nigeria (TOAN) and the Motorcycle Operators Association of Lagos State (MOALS) are both under the NURTW. The two unions are not independent and all the money collected from them goes into the purse of the NURTW.

As illustrated earlier, agberos collect an average of N3,000 from commercial buses, N1,800 from tricycles and N600 from motorcycles each day.

However, outside this amount, they collect and submit only N100 or N200 to local government area councils or LCDAs, taking the larger chunk of what many consider as ‘spoils of violence.’

This was confirmed by some agberos who spoke with this reporter. Chairman of Ikeja Local Government Area Mojeed Alabi Balogun also confirmed this to the reporter, saying that his council receives N200 per day from each park.

An opaque process

As shown by the videos uploaded in this story and the pictures below, most agberos in Lagos do not issue tickets, making accountability to whoever they report to, impossible.

Some of them appear in yellow uniforms with green caps to match, while others wear green and white attire. Many others appear in mufti, making it difficult to know which is which.

“In Lagos, due to lack of regulation of the sector, it is possible for anyone to start collecting money from commercial buses, tricycles or motorcycles and do that for three months without anyone asking questions,” a commercial bus driver, who gave his name as Okebukola Oyedeji, said.

A bus driver known by his first name, David, said there could be as many ticket touts in Lagos as commercial bus drivers.

“You can wake up one day as a commercial bus driver and meet 10 ticket touts. Sometimes, you meet more. They will fight you, hit your bus, break your side mirror and even injure commuters while trying to extort money from you,” David, who operates from Ikeja to Ojota, told The ICIR.

Another bus driver, Olufemi, explained that ticket touts could ruin a commercial bus driver’s day.

“If they want to ruin your day, they simply park your vehicle. It will take a lot of money from you to ‘bail yourself,” the driver who was not keen at giving out his name, said.

Findings show that only very few agberos issue tickets. Even when they do, they issue tickets with face values of N300-N400 but collect N2000 or more.

In Lagos Island East LCDA, agberos issue two tickets of N300 face value to tricyclists but collect N1800-N2200 each day.

In Coker/ Aguda LCDA, the NURTW issues tickets of face value of N120 to motorcyclists but collects N600 to N700 each day from them. The reporter found this anomaly in all the 21 LCDAs visited in Lagos.

Chairmen of the two LCDAs Kamil O. Salau and Akinyemi-Obe Omobolanle did not respond to calls and text messages sent to them on issues regarding transport taxes in their areas of jurisdiction.

Most of the NURTW members spoke with the reporter in camera. Efforts to reach Chairman of the NURTW Musiliu Akinsanya proved abortive as two phone numbers given to this reporter as belonging to him did not go through.

In all the LCDAs visited by the reporter, it was found that agberos in mufti often had markers of different colours with which they identified paying vehicle drivers or motorcyclists.

Sometimes, the markers can be up to three, as in Isolo, Ikorodu, Oshodi, Iru/Victoria, Mushin, Bariga, and Itire/Ikate, among others. The agberos with the markers often do not issue tickets and they collect mostly N100-N200, investigation found.

The most bizarre part of the agbero show in Lagos is that failure to comply with payment of these multiple taxes often lead to fights or removal of essential parts of the vehicles. For motorcyclists, their seats are removed.

Impact on transport cost

The activities of touts have raised transport costs across Lagos. A tricyclist at Isolo LCDA, who did not want his name mentioned, said passengers would have been charged N50 for most places in the LCDA but for the activities of touts.

“From 7 & 8 to Canoe could have been N50, but we charge N100 or N150 (in the evening) because agberos also want their own share,” he said.

A commercial bus driver, Sam, plying Oshodi area, said that moving from Oshodi to Ilasamaja used to cost N50 but most drivers now charged double or triple of that due to demands by agberos.

“From Oshodi to Mile 2 is N200. It used to be N100 and later N150, but agberos‘ charges have raised the transport cost,” Sam said.

Another commercial bus driver plying Amuwo-Odofin area said passengers were paying double due to the many charges by touts.

And it is rubbing off on commuters.

A commuter from Ayobo/Ipaja LCDA to Bolade in Oshodi said she spent N450 each day, noting that the cost would not have been above N300 if not for touts harassing commercial vehicle drivers.

“Before drivers move from Ayobo to Oshodi, they pay different amounts to up to six sets of touts. We are the ones suffering it and bearing the burden,” the commuter, who gave her name as Ngozi, said.

Another commercial bus passenger, Oluwabunmi, who said she plied Ikotun to Cele, two separate LCDAs in Lagos, said transport cost was eroding her income, no thanks to agberos.

“I earn a salary of N35,000 monthly but I spend more than N15,000 on transportation because of agberos dictating fares to drivers and exploiting them.”

Nigeria is the poverty capital of the world, with 105 million people, which is 50 per cent of the population, in extreme penury, according to the World Poverty Clock. Unemployment in Nigeria reached a record 33.3 per cent in the fourth quarter of 2020 as against 27 per cent in the second quarter of the year.

Inflation was 17.75 per cent in June 2021 but food inflation was 21.83 per cent, meaning that many Nigerians spend a lot of their income on food.

With rising transport costs, fuelled by non-state ticket touts, lives of people in Africa’s most populous nation have become hellish.

“They are just adding insult to injury. The fact that the state government does not understand how these touts impoverish Nigerians is a source of worry,” A British-born Nigerian Ese Dimitiri told The ICIR.

“Those responsible should cover their faces in shame for failing the society,” she said.

Agberos rip off Lagos while infrastructure decays

If Lagos were a country, it would be among the seven largest economies in Africa.

Official estimates in 2017 put the size of the economy at $136 billion -32 per cent of Nigeria’s Gross Domestic Product (GDP) at that time.

However, it is, perhaps, one of the few mega cities in the world without light rail systems. In Africa, Johannesburg (Johannesburg -Pretoria Railway) , Addis Ababa (Addis Ababa Light Rail) and Nairobi (Mombasa-Nairobi Standard Gauge), among others, have railway systems that enhance the movement of the people within the cities, but not so in Nigeria’s richest state.

Light has come at the end of the tunnel with Lagos-Ibadan Railway, but it does not cover intrastate movement in Lagos.

While agberos fleece the state of over N123 billion yearly, infrastructures in the state rot.

Roads in several communities, ranging from Ikotun to Ejigbo local council areas, are in dilapidated state, with over 20 million residents spending hours in traffic.

Nurudeen Obe Street in Ejigbo LCDA is a typical example of the failure of the state government to provide good road infrastructure for residents.

Areas like Ijagemo and Ijede are also other examples.

In mid-July 2021, Minister of Works and Housing Babatunde Fashola announced that the Federal Government had awarded five road contracts to Dangote Group.

One of the road contracts (49.15 km) connects Bama to Banki in Borno State (at N51.02 billion). Another (49.58km) road connects Dikwa to Gamboru-Ngala, also in Borno State (for N55.5 billion). Total amount budgeted for the two (98.73km) roads was N106.52 billion.

Experts say that the N123.078 billion collected by agberos can build more than 100km of roads in Lagos.

In a research entitled ‘Economic Valuation of Poor Road Infrastructure Lagos: A Focus on Urban Households,’ Austin Otegbulu of the University of Lagos said, “The interface between transportation investment and economic development has broad ramification that goes beyond the basic purpose of moving goods and people.”

Agberos holding Lagos to ransom

On many occasions, Lagos agberos, who often work as thugs for politicians, hold Nigeria’s richest state to ransom.

Many people argue that they are so wealthy that they can shut down Lagos any day they so wish. And this has happened many times.

In February this year, there was a fight between rival agbero factions at Obalende in Lagos. The area was shut down for hours as violence went on. Police and other security agencies stayed away.

On July 14 this year, soldiers and agberos fought at the popular Ladipo auto spare parts market, leading to the death of five people.

There have been several clashes among ticket touts or agberos in Lagos, leading to deaths or shutdown of critical parts of the state, which is Nigeria’s biggest investment destination.

“The Lagos state government has more directly empowered crime bosses in the NURTW to create an alternate economy for themselves and determine the outcome of elections in the state,” Lead Partner at SBM Intelligence Cheta Nwanze said in a February 2021 article.

Nwanze’s article from which the quote above was taken was challenged by Lagos State government, but the Lagos State officials have taken a position in favour of the NURTW, which was banned by Oyo State government in 2019.

“The National Union of Road Transport Workers (NURTW) is actually a union recognised by law. I know some people say ban them, but the government must also be carefu,” Deputy Governor of Lagos State Obafemi Hamzat said in September 2020.

“When you just say arbitrarily ban them, what stops you from saying I want to ban Nigerian Medical Association (NMA)? Do you understand? There are times government and NMA have issues; does that mean they should be banned? They are expressing their opinion. They might be wrong or right but they have the right to express those opinions. And then remember these people (NURTW) are Nigerians; they are our brothers and cousins.”

How transport tax is handled in South Africa

The South African National Roads Agency (Sanral), managed by the government, is responsible for road and traffic administration in the country. It has offices in all the cities, including Cape Town and Pretoria.

Like the NURTW, it collects road taxes, but unlike the NURTW, it declares money collected. In 2019 and 2020, Sanral reported R687 million (equivalent of N19.5 billion) and R660 million (N18.75bn) respectively from collection of e-tolls.

Tolls and fees collected from the cities go to the central purse, from where projects are executed.

The agency is currently spending R1.65-billion on the construction of 1.1-km-long Mtentu Bridge near the Wild Coast in the Eastern Cape.

Tax leakages in Nigeria

There are tax leakages Nigeria. A few individuals steal government taxes while some corporate organisations evade or avoid taxes.

Tax evasion occurs when a person or firm deliberately avoids paying tax illegally. On the other hand, avoidance is “the use of legal methods to minimize the amount of income tax owed by an individual or a business,” Investopedia explains.

In 2020,Nigeria’s chief tax collector, the Federal Inland Revenue Service (FIRS), said that there were $10 billion in tax leakages arising from multinational corporations’ illicit profit shifting (to low-tax jurisdictions).

Executive Chairman of the Federal Inland Revenue Service (FIRS) Muhammad Nami had also said in January 2021 that Nigeria lost $178 billion to tax evasion by multi-nationals in 10 years.

A 2018 report by the Partnership for Social and Governance Research cited a research work by the High-Level Panel on Illicit Financial Flows from Africa, which showed that Nigeria accounted for 30.5 per cent of illicit financial outflows ( including taxes) from the continent.

The research by the Partnership for Social and Governance Research said that Africa’s most populous nation lost $217.7 billion to illicit financial flows (including tax outflows) between 1970 and 2008.

Lagos State has always complained of tax evasions or avoidance. On July 19, 2021, the state sealed 16 firms over tax evasion.

“Now, the service has resumed sealing of firms particularly the hospitality firms. It is committed to continuing the exercise until full compliance to tax payment and remittance are achieved,” LIRS Director of Legal Services Seyi Alade was quoted to have said.

However, the state is reluctant to plug, perhaps, the biggest tax/revenue leakage in the country, which is transport revenue going into personal pockets of non-state actors.

The reporter had earlier done a story on how local government officials steal government taxes/levies with impunity.

Which way Lagos?

Some Lagosians say that the agbero phenomenon is a way of creating jobs for the teeming unemployed persons in Lagos.

The unemployment rate in Nigeria was 33.3 per cent in the fourth quarter of 2020, according to the NBS. However, Lagos has a high unemployment of 37.14 per cent –higher than the national average.

A Lagos-based businessman Olugbenga Adeniyi said every cloud had a silver lining, pointing out that agbero business was a way of taking many out of the streets.

However, Deputy Director of the Socio-Economic Rights and Accountability Project (SERAP), which focuses on economic, social rights and transparency, Kola Oluwadare, told the reporter that the issue lied in financial transparency and accountability.

“It is not only in the transport sector, but it extends to other sectors in the state,” he said.

He said he would be surprised if there were no report of Lagos State auditor-general on transport revenue in Lagos.

“Auditor-general should be the one to look into all the accounts. I will be surprised if the auditor-general has not looked into it and made recommendations on that.”

A finance expert Bala Augie expressed the need for the state government to digitise the process and enable transporters to pay the rates/ taxes into designated accounts or through fintech platforms.

“They can begin to gradually embrace digital payments to reduce the level of leakages not just in transport sector, but also in other areas where there are other leakages,” he recommended.

A market analyst, manufacturer and managing director of a servicing company Ike Ibeabuchi said, “Solution to Lagos State lack of transparency is the solution to Nigeria’ s lack of transparency.”

He suggested disbandment of agberos in Lagos and re-organising them for efficiency and accountability.

Oyo State Governor Seyi Makinde banned the NURTW in 2019 due to impunity and absence of transparency.

“But I know that the willingness to do this is lost because the so-called touts have their relevance during politics,” Ibeabuchi said.

Former Director-General of the Lagos Chamber of Commerce and Industry (LCCI) Muda Yusuf toed Augue’s line, stressing the need to move all transactions online or via the banks.

Your content is well-written, offering clarity and arousing interest in readers. Keep up the exceptional effort.

Comment:

Your report about how Agberos pocket billions by of Lagos transport revenue is good and detail.

This report however is not peculiar to Lagos state alone. You need to go to other part of the country, agberos has now become one mainstream of income for the boys everywhere.

NURTW is a National Union and they are actually everywhere in Nigeria from urban to the most remote of the rural areas. This will continue until we have a working constitution in Nigeria. So many activities are going on in the country without proper monitoring or management. One example is the so called agberos.

How Are You. Zendaya Height.I would like to take the ability of saying thanks to you for the professional suggestions I have usually enjoyed

browsing your site.Excellent post. Known for her beautiful voice and attractive acting, Zendaya was born on 1 September 1996 in Oakland, California, the United States. Her career started as a child model and break-up dancer, before stardom came with her role as Rocky Blue on the Disney Channel sitcom Shake it Up (2010-2013).